Billy McFarland is making another go at the music-festival thing—trust him. McFarland was the man behind Fyre Festival, the gold-crusted 2017 concert in the Bahamas that turned out to be the most marketable failure in the history of event planning. McFarland raised a few million dollars, paid some A-list Instagram celebrities to promote it (stealthily, those influencers thought), and skipped over a few things more fundamental to a destination music festival, like food, lodging, performances, and the basic physical comfort of the people involved. The whole thing unraveled—but only after concertgoers had arrived on-site.

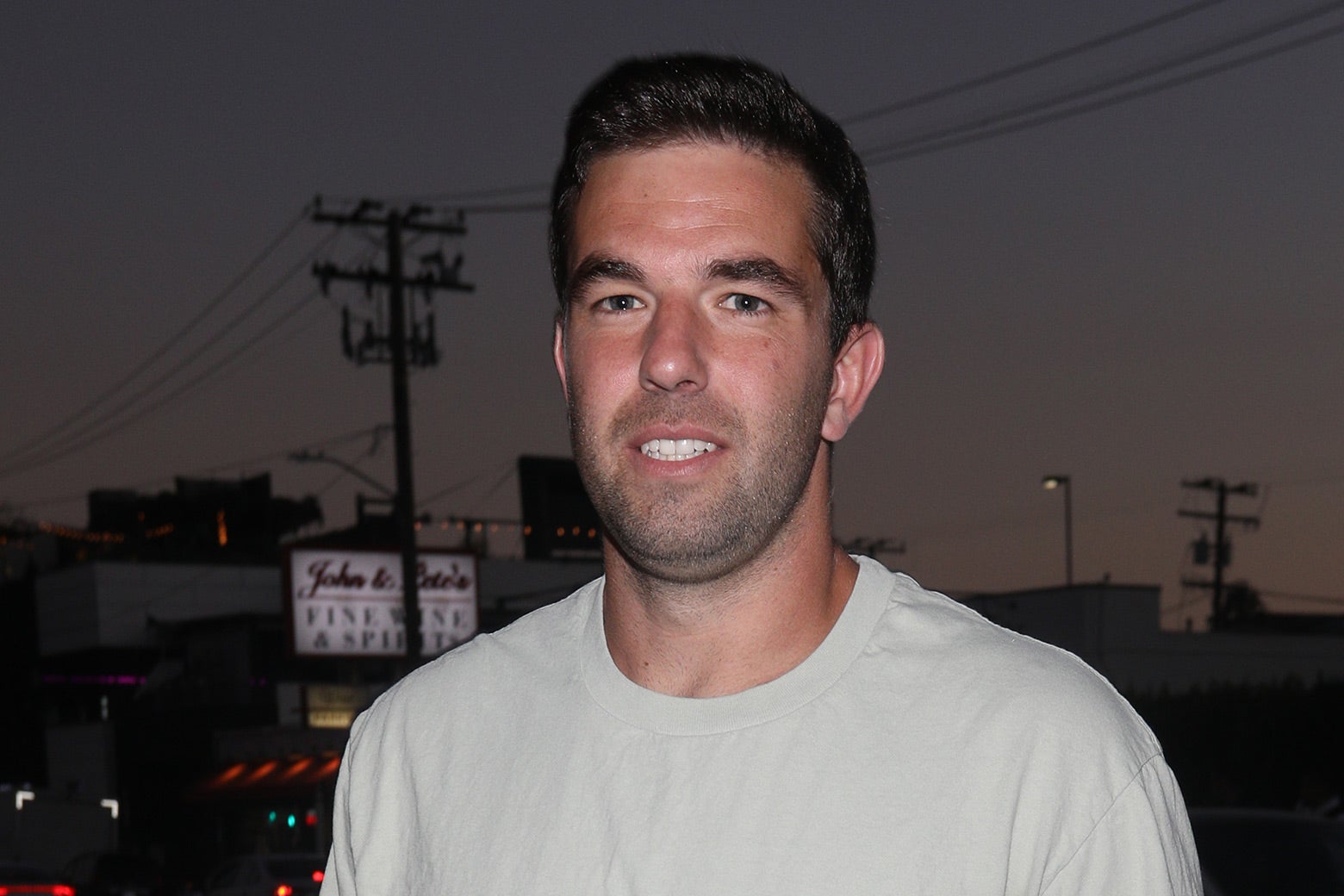

McFarland defrauded investors (obviously) in the course of setting up this nonfestival festival. He eventually pleaded guilty to wire fraud, admitting that he cooked up fake documents to attract money and also that he sold fake tickets to fashion shows and sporting events. The price tag of all this bilking of investors and customers worked out to $26 million, the Justice Department said, and McFarland went off to prison. He became much more famous from the inside: McFarland’s shenanigans became the subject of two well-received 2019 documentaries that came out within days of each other. He got out of prison last spring, not long after serving a confounding six months in solitary confinement, and quickly launched exactly the press offensive one would imagine: “Billy McFarland Is out of Jail and Ready for His Next Move,” reads the headline in the New York Times, above a dimly lit portrait of the subject.

His next move—if you’re willing to believe him—is a new Fyre Fest. On Tuesday, McFarland announced on YouTube that he was resurrecting his dead-on-arrival creation after pondering the idea in solitary. It’ll be somewhere in the Caribbean, he said, with a target date around the end of 2024. “Guys, this is your chance to get in,” he said. McFarland said later in the day that the first “drop” of tickets had sold out, a claim that may or may not be true. (Again, one of McFarland’s crimes was the sale of fake tickets.) That “drop” appears to have been 100 tickets for $500 each, which is a genuinely amazing haul, and future “drops” will see the prices of tickets supposedly get as high as $7,999 a pop. Whether McFarland is selling fake tickets a second time or selling real ones at these price points, it’s a truly audacious moment in capitalism. This guy?

And yet McFarland is doing the most natural thing imaginable, calling a play out of the only playbook he could possibly use. America is a land of opportunity for white-collar criminals with a story to tell, and McFarland is far from the first to attempt such a comeback.

It’s a real dynamic in American business, written about so well by Bloomberg’s Matt Levine, that imploding spectacularly in one’s financial pursuits is a viable way to earn new opportunities. The classic example: If some investment banker loses a billion dollars, then he will probably be fired, but at least he’ll have demonstrated that he was a big-enough deal for someone to trust him with a billion dollars. Only impressive people manage to cause that kind of damage. Unimpressive people wouldn’t get the chance in the first place.

It is pretty clear that the same principle applies to actual financial wrongdoers and criminals for whom the jig has already been up. In 2021 former hedge fund guy Bill Hwang, who once paid millions after being slapped with insider trading charges by the Securities and Exchange Commission, got to blow up the stock market for a few days. That became possible only because some of the most prestigious financial institutions in the world, as well as some extremely wealthy individuals, decided to lend him money that he could throw around to move the market. Goldman Sachs, which reportedly once had Hwang on a blacklist, believed in his comeback. There are business revival stories and reputational revival stories to match. Investor and financier Michael Milken spent 22 months in prison for securities fraud beginning in 1990. But Milken’s philanthropy and friendships eventually detoxified his name so much that his prison time was just a tiny piece of the story when George Washington University put his name on a school in 2014. If your misdeeds were enormous but financial in nature, you can bounce back.

Of course, figures like Hwang and Milken had lots of money to put into polishing their profiles, and McFarland, a younger man who agreed to a $26 million forfeiture in his plea deal, probably doesn’t. But consider how gracefully other financial miscreants have gotten giant institutions, which have a structure for weighing the risks of their associations, to climb back into bed with them. McFarland doesn’t even have to do that sort of wooing. His target clientele is not Credit Suisse (rest in peace) but … millennials who spend too much time online? Attractive people with Instagram accounts? These are not groups that do robust vetting of much of anything, and McFarland’s crash and burn gave him an extremely valuable currency with that demographic: fame.

McFarland is known for being a dumbass and a liar, but he is known. There are many ways in which his rebooted music festival could and likely will fail, assuming that it even materializes at all. But McFarland’s star turn as his life collapsed into rubble has made him an undeniable curiosity. Wall Street types who flame out get to try again because there is something substantive about being in a high-enough position to make headlines for white-collar crime. Someone like McFarland gets to try again because, no matter what happens with a new music festival that quite possibly will never come into existence, throwing a few dollars in his direction will at least make for a C-plus story. And for McFarland’s purposes, it’s not clear that the festival even has to work. Its planning, such as it is, may well just have to be something that the cameras can capture for a documentary he’s participating in.

We should all be able to tell where this is heading as a genre. Sam Bankman-Fried sits in a jail cell awaiting his trial this fall over his central role in the collapse of his crypto exchange and his alleged misuse of customer funds. The reason he’s in jail before trial is that Bankman-Fried was an incredibly annoying defendant for the judge and prosecutors—most specifically, the prosecutors said, by sharing case documents with a New York Times reporter. Bankman-Fried spent much of the time after FTX’s destruction talking to as many reporters and podcasters as he could. Elizabeth Holmes, the Theranos fraudster who recently began her own prison sentence, sat for a Times profile before she went away. (She is now Liz, not Elizabeth.) Holmes had already gotten her sentence when she embarked on that public-relations offensive, and the timing was telling: There was no hope of changing her near-term fate, but maybe there was hope of softening her image for whatever would come later. Today there’s a Fyre Fest II. Tomorrow there will be an FTX II or a Theranos II, because no volume of industry bans or securities regulation can keep down a white-collar crook with a loud-enough microphone.